Navigating Tax Collection with Kickstarter’s Pledge Manager

This guide will help you choose the right approach for tax collection and communicate transparently with your backers throughout the process.

You've successfully raised funds through crowdfunding, and now you're ready to fulfill orders to your backers. This is where logistics like shipping, taxes, and duties come into play, and it’s important to understand your options.

Pledge Managers and surveys were developed to help with these types of post-campaign logistics and have evolved significantly over the years.

What started as basic address collection forms have become sophisticated systems that handle everything from product customization and tax calculation to shipping costs and post-campaign upsells.

Today, creators can choose from platform-integrated tools, third-party solutions, or simple survey options, each offering a different range of capabilities.

No matter how you plan to handle taxes and post campaign logistics, this guide will help you make informed decisions and set the right expectations for your backers.

Understanding Taxes & Kickstarter

Let’s start with the basics: when backers pledge during your Kickstarter campaign, you can set a reward price and a shipping fee, but the platform doesn’t provide tools to charge taxes at the point of pledge.

Why? Because pledges aren’t purchases. They’re a commitment to support something that doesn’t exist yet. Until you’ve made and delivered your creation (often months later), any associated taxes aren’t applicable.

A pledge is a voucher: a promise to exchange money for something real, conditioned on its creation, whether that’s a book, a game, a piece of tech, whatever you’re bringing to life.

When you wrap up production and start thinking about shipping rewards to backers, that’s when your tax obligations become concrete. You now know exactly what you’re sending to backers, and from where in the world. You’ll collect backer addresses at this point, so you’ll have more clarity as to their tax jurisdictions, too.

Three Approaches to Post Campaign Tax Collection

Today, creators have a few different paths for handling taxes & post-campaign logistics. You can use platform-integrated tools, turn to a third-party service, or stick with a simple survey-based approach. Each option offers different levels of customization, automation, and control. What’s right for you depends on your project’s needs and complexity.

The key is communicating your plans to your backers from the get-go so there aren’t any surprises.

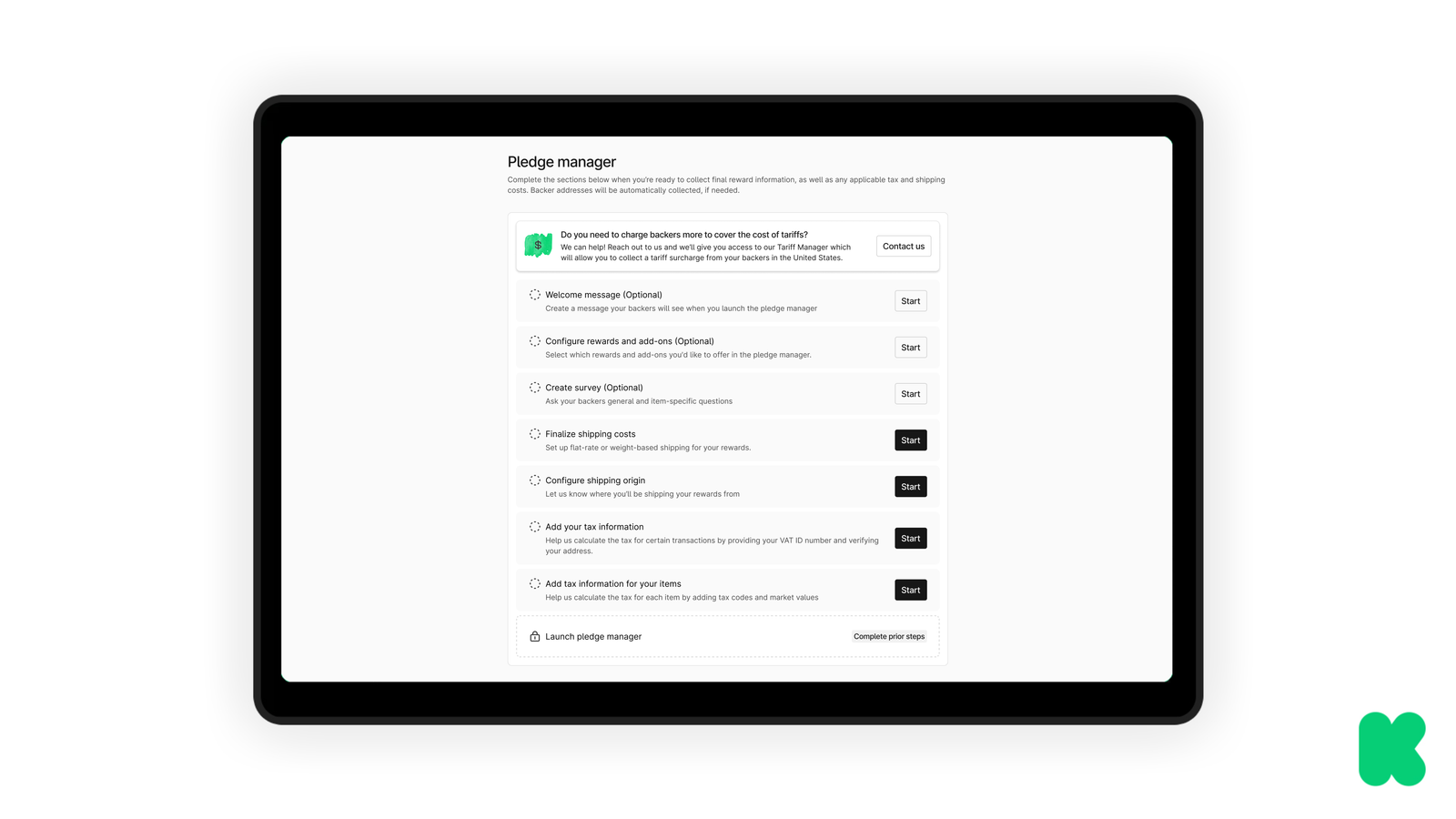

Option A: Kickstarter's Built-in Pledge Manager

How it works: Kickstarter automatically collects applicable taxes during the post-campaign pledge manager phase for backers in the US, Canada, UK, and EU.

Benefits:

- Kickstarter handles tax collection and remittance in major markets

- Compliance is simpler when you’re faced with fast-changing tax laws with minimal effort on your part

- You avoid the risk of undercharging or absorbing costs yourself

There are also benefits for your backers:

- Seamless customs clearance with pre-paid VAT; no delays and no surprise fees for your backers

- Backers pay the tax actually required for each transaction, ensuring fair and accurate pricing

- Tax costs are no longer hidden or baked into pledge levels, giving backers full transparency around what they are paying for

Considerations:

- You're responsible for tax obligations in non covered regions and use cases (see this help center article for more details on what is covered)

- If backers weren’t expecting these charges post campaign, they may be caught off guard, so communication during your campaign is key

Option B: Third-Party Tools (PledgeBox, BackerKit, etc)

How it works: You maintain control over tax collection decisions across all regions. Third-party platforms offer flexible interfaces to set custom tax percentages, but you handle all compliance and remittance.

Benefits:

- Complete flexibility in tax approach

- Can account for tax in all shipping jurisdictations

- Option to build tax allowances into initial reward pricing for simpler backer experience

Considerations:

- You take on full responsibility for tax compliance across all jurisdictions

- Reward margins may fluctuate since backer locations are unknown during campaign

- Potential for unexpected tax obligations

Option C: Kickstarter's Basic Survey Tool

How it works: This lightweight tool lets you collect shipping addresses and simple info (like size or color), but you can’t charge taxes, shipping, or offer add-ons.

Benefits:

- You retain full control over how and when you handle taxes

- Straightforward tool suitable for smaller projects

Considerations:

- You’re still liable for taxes but won’t have tools to collect them after the campaign

- Limited functionality with no option for upsales or add-ons

Using Kickstarter's Pledge Manager? Here’s How to Prepare Your Campaign and Set Backer Expectations

Kickstarter's Pledge Manager is designed to streamline your post-campaign fulfillment process, handling everything from backer surveys to tax collection and remittance. One of its key features is automated tax compliance across supported jurisdictions. To take advantage of this powerful tool, there are specific requirements and best practices you'll need to follow during your campaign setup.

Key Requirement: Keep Tax Separate from Pledge Amounts

Because Kickstarter’s Pledge Manager collects and remits sales and value-added tax on Pledge Manager transactions, you can’t charge or include tax in your pledge tiers if you plan to use our Pledge Manager.

Why can’t I charge tax during the campaign?

Because pledges are not confirmed purchases until the creator successfully produces the object of the campaign after crowdfunding is successful. Purchases are not final, and tax is not applicable, until the creator is ready to fulfill.

Instead:

- Tax will be calculated after your campaign ends, when pledges become confirmed purchases

- It will be based on your backers’ shipping location and the specific reward they selected

- Kickstarter will automatically collect the correct amount and remit it to the appropriate authorities in supported jurisdictions

Setting Expectations: What to Tell Your Backers

Communication is key to a smooth post-campaign experience.

Kickstarter’s Pledge Manager makes it simple for you to collect any required taxes after your campaign, based on where your backers live and what they’ve chosen to receive. Below are a few places you can include this information to help set clear expectations with your backers:

- Dedicated Section in the Campaign Story

- You can make a dedicated section with "Shipping, Taxes, Tariffs and Duties" (or any collection of variable cost info) on your campaign page (usually near the bottom). Here is an example of shipping guidance creators provide in a section like this:

- In Your Campaign FAQ

- "Will I be charged sales tax?"

- Yes, applicable sales tax or VAT will be collected when you complete your backer survey in Kickstarter's Pledge Manager after the campaign ends. This ensures you pay only what's legally required based on your shipping location and reward selection.

- "Will I be charged sales tax?"

- In Your Reward Descriptions

- You can put a brief mention of the tax and shipping expectations in the bottom of your rewards description, for example:

- SHIPPING & TAXES: Shipping and taxes are NOT included. You’ll pay those when your reward is ready to ship. (More info in the Shipping & Taxes section)

- You can put a brief mention of the tax and shipping expectations in the bottom of your rewards description, for example:

- In Your Campaign Updates

- Consider adding something like: "A quick note about taxes: We're using Kickstarter's Pledge Manager. If you are a backer in the United States, Canada, United Kingdom, or European Union, any required sales tax or VAT will be collected when you fill out your post-campaign survey. This ensures you're only charged the exact tax amount required for your location and keeps us compliant with tax laws worldwide."

Checklist For Campaign Set-Up

✅ Add transparent information on your campaign page, FAQ, and/or reward descriptions so there are no surprises later (See communication guidance above).

✅ Set clear expectations with backers - let them know that applicable taxes will be calculated after the campaign ends

✅ Don't include sales tax or VAT in your reward pricing

What Is a Marketplace Facilitator? (And Why It Matters)

You may have seen references to Kickstarter being a marketplace facilitator throughout this guide. Here is what that means and why it’s important. Think of platforms like Amazon, Etsy, or eBay. When you buy something on these platforms, they collect sales tax at checkout, not the individual sellers. These platforms, and other e-commerce solutions, operate as marketplace facilitators.

A marketplace facilitator is a platform that:

- Processes payments between buyers and sellers

- Provides the infrastructure for transactions

- Is responsible for tax collection and remittance

Kickstarter’s Pledge Manager operates as a marketplace facilitator and handles tax collection just like these other major platforms. This ensures everyone stays compliant with evolving tax laws.

The Bigger Picture: Industry Evolution

This shift marks a major step forward for crowdfunding as a whole. In the early days, tax handling varied widely, some creators absorbed the costs themselves, others didn't collect taxes at all, and many were left navigating complex regulations on their own.

By operating as a marketplace facilitator, Kickstarter is aligning crowdfunding with modern e-commerce practices. That means greater transparency, simpler compliance, and clearer expectations, helping creators focus more on their projects and less on administrative hurdles.